SaaS based microbanking system – Mambu

Problem Space:

My team in Carnegie Mellon’s MHCI capstone project was sponsored by Promosoft group, a leading software development company based in Lisbon, Portugal. Our problem statement was to come up with a product idea that could potentially help small financial institutes that are trying to cater to the needs of people that had no access to a conventional bank due to financial hardship and distance from big cities.

Research:

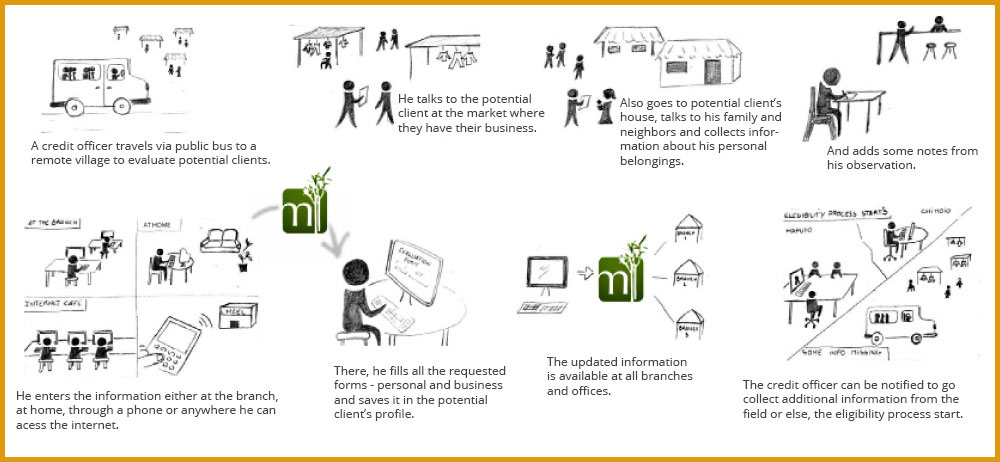

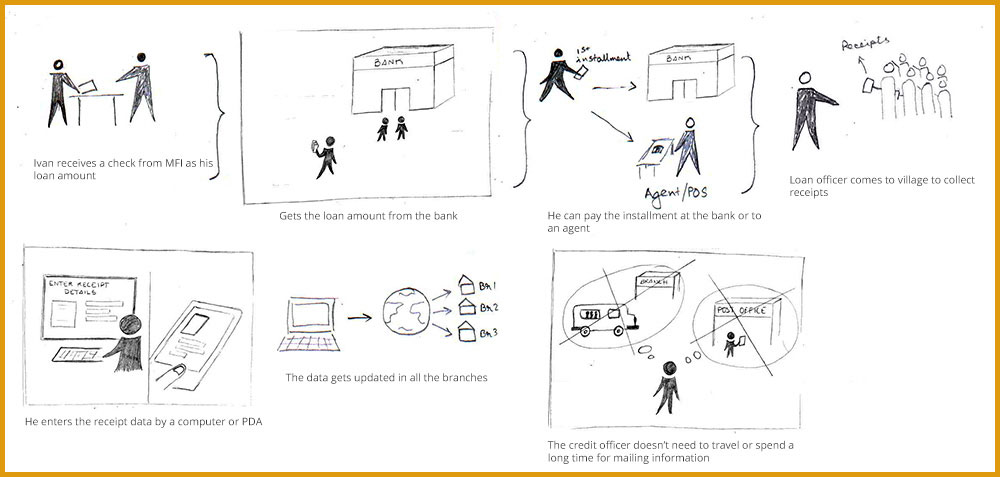

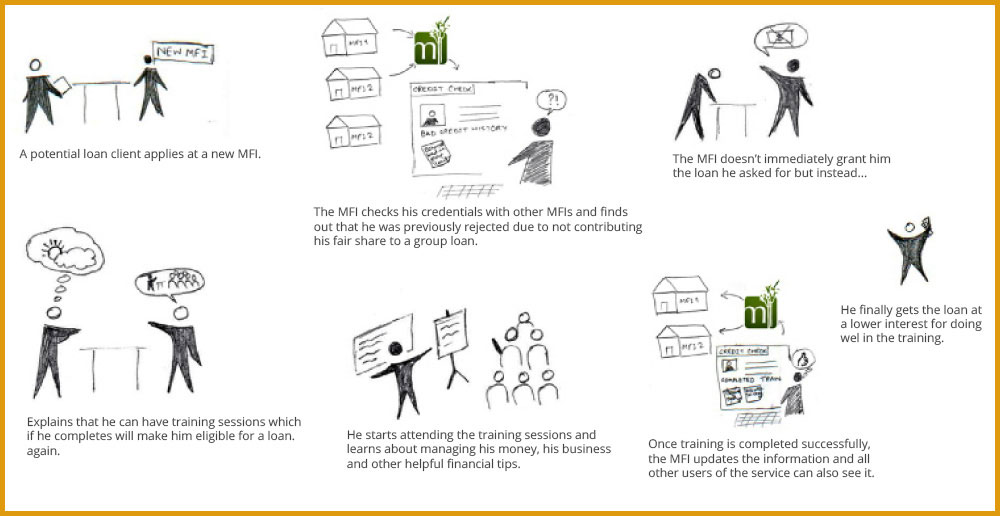

Based on our Ethnographic study in Mozambique, we understood the daily life and challenges posed on the target users. We sketched out number of user journeys in the form of story boards based on our observation and contextual inquiries. Some of us managed to hop onto mobile banking vans or even follow loan officers to remote villages during their inspection.

Solution:

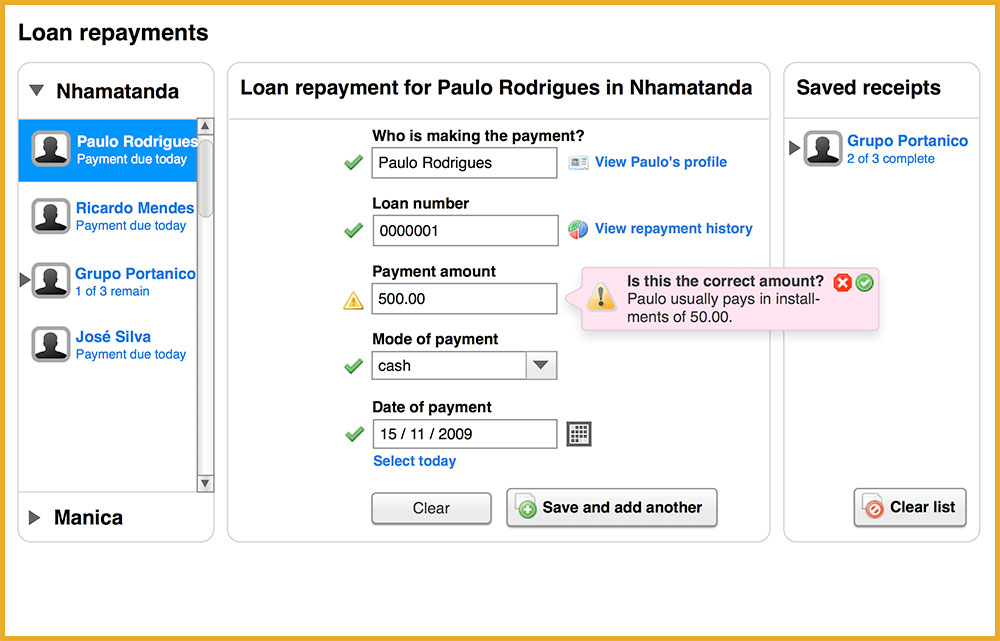

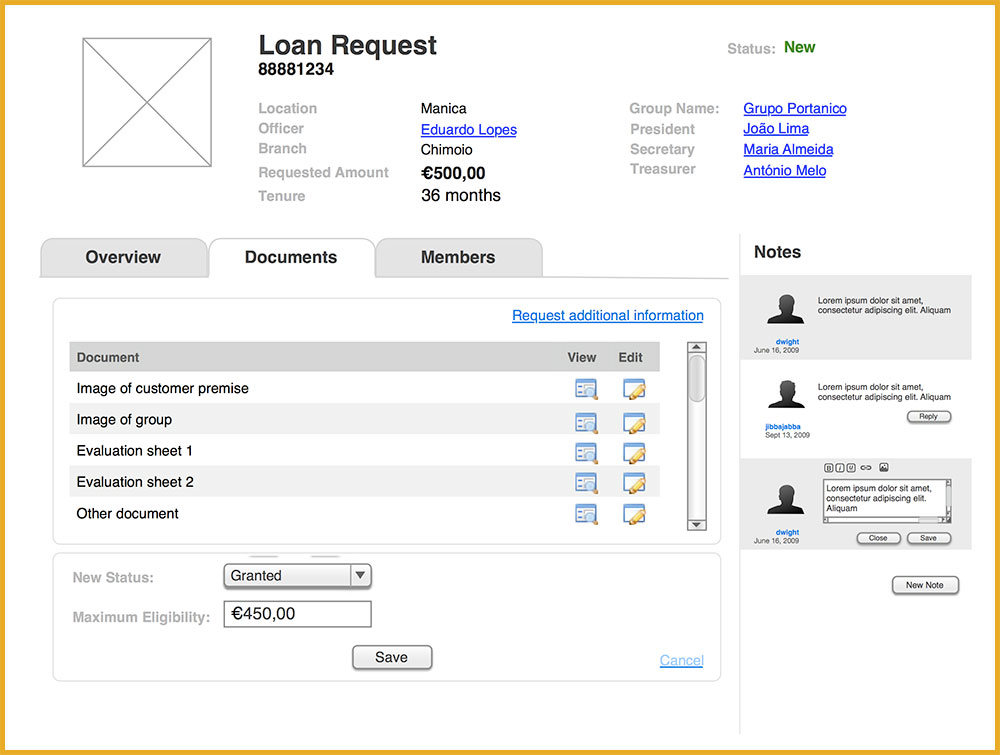

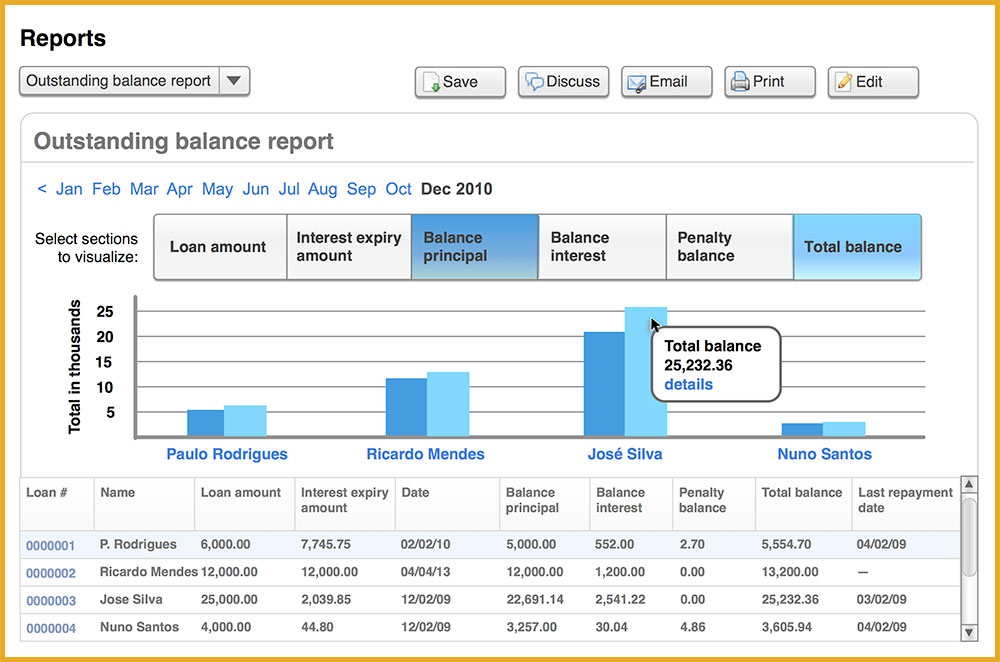

After coming back from the field we synthesized the data, and it was inferred that the nature of the problems that the small rural banks face can be addressed by a SaaS based Micro Finance system. Micro-finance helps the poorest of the poor by giving them access to much needed credit to build a new home, pay for education or create a self-sufficient business to improve their lives. Until then, technology for micro-finance had placed a great burden on the conventional financial institutes, diverting them from focusing on providing their services. And the smallest organization that needed the technology the most, were unable to afford or access it.

.

Carnegie Mellon class of 2009 Capstone Project

February 2009 – November 2009 | Team size – 5

What I did

- Ethnographic Study

- Storyboard

- Interaction Design